r&d tax credit calculation software

Ad ProSeries is fueled by 1000 error-finding diagnostics and saves you time on every return. Our RD tax credit calculator estimates the tax relief you can claim under the SME scheme.

Using R D Credits To Reduce Payroll Taxes An Overlooked Opportunity For Startups

Calculating RD Tax Credits.

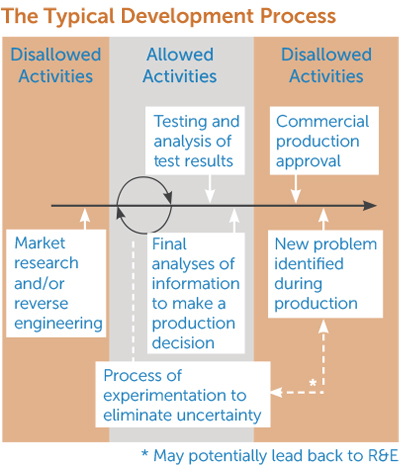

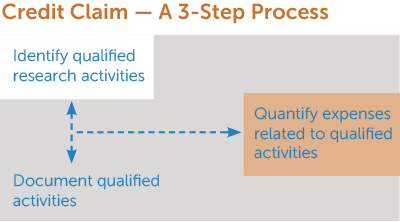

. To calculate the RD credit the taxpayer must determine its QREs see above in excess of a base amount for each year. As a simple example well use an RD spend of 100000 for the purpose of this RD tax credit calculation and apply it to the following steps. Save accounting clients money with 1600 tax planning strategies.

Admin dashboard with progress tracking. The results from our RD Tax Credit Calculator are only estimated. Credits for software companies can result in a credit exceeding 10 of expenditures but some potential limits exist.

Use Titan Armors calculators to estimate your state and federal RD tax credit benefits or to see if you can offset your payroll tax. ProSeries time-saving features make it easy to use from anywhere at any time. In general profitable SMEs can benefit from average savings of 25 so if a company were to spend 100000 on RD projects and make an RD tax credit claim they.

Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator. Ad Browse Discover Thousands of Reference Book Titles for Less. RD Tax Credit Calculator.

The term base amount is defined by multiplying the fixed-base. Multiply average QREs for that three year period by 50. Add uplift to your.

Its easy and free. From biotech to breweries were on a mission to democratize the RD tax credit. Manage SMEs and tasks.

Clarus RD for your business. Get Started with No Tax Planning Experience. Our RD Tax Credit Calculator is a quick and useful tool for estimating the potential value of your RD tax credit claim and all you have to do is answer some simple.

Identify and calculate the average QREs for the prior three years. The first is the Regular Credit which compares your current RD qualified expenses to historic RD spend by. TaxRobot is the most efficient way to automate your RD tax credit.

RD Tax Credit Calculator. Were here to make sure every qualified company gets the most out of their. Ad Tax Planning Software for accounting firms.

This is the scheme that covers most startups and it offers a higher rate of tax relief. Subtract half of the three-year average Step 2 from current year. Technically the credit is to help increase.

Central hub to communicate with project managers. There are two 2 different calculation methods for the RD tax credit. Compliant defensible RD tax credits.

Federal and state credits.

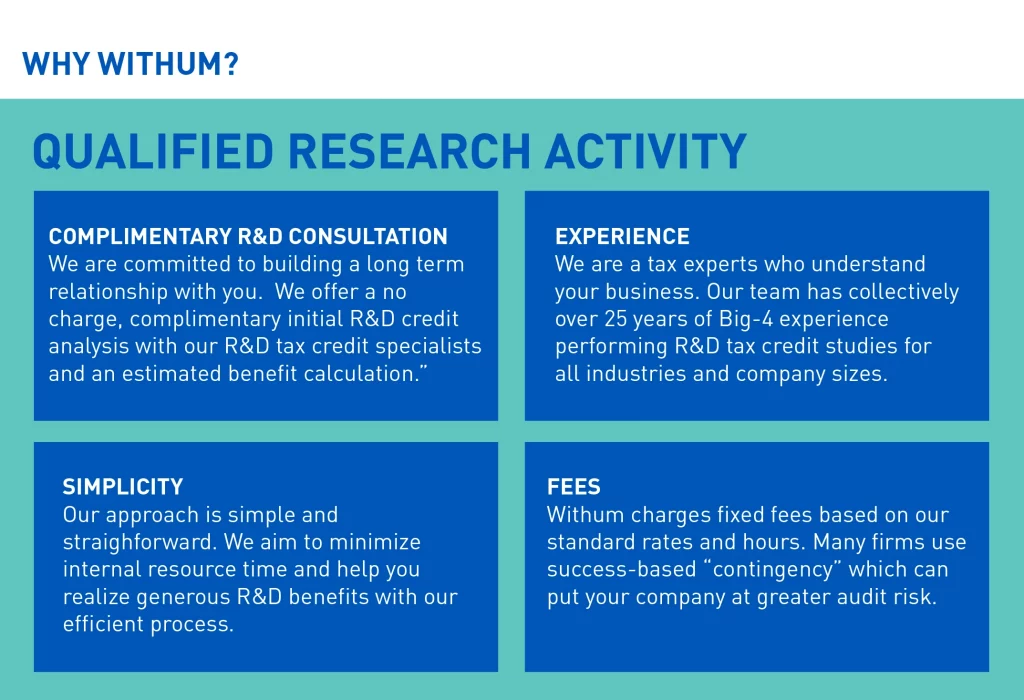

Software Development Industry Tax Credits R D Tax Credit

History Of The R D Tax Credit In The U S

What Is The R D Tax Credit Who Qualifies Estimate The Credit

Research Development R D Tax Credits Faqs Bdo

How To Calculate The R D Tax Credit Alternative Simplified Credit

How To Fill Out Form 6765 R D Tax Credit Rd Tax Credit Software

Claimer Raises Seed Backing To Make It Easier For Uk Startups To Claim R D Tax Credits Techcrunch

Tax Credit For Increasing Research Activities Tax Services Cla Cliftonlarsonallen

R D Tax Credit Software How Do You Calculate R D Tax Credit

Tips For Software Companies To Claim R D Tax Credits

Changes To Alternative Simplified Credit Helps Your Business

New Home Rd Tax Credit Software

Own A Start Up Or Small Business You May Qualify For Federal Research Credits

New Home Rd Tax Credit Software

Tax Credit For Increasing Research Activities Tax Services Cla Cliftonlarsonallen

R D Tax Credits Can Help Your Clients Subsidize Software Development

R D Tax Credits Irs Form 6765 Instructions Adp

Kbkg Tax Insights R D Tax Credit Qualified Research Expenses For Software Development Activities