nassau county property tax rate 2021

This is the total of state and county sales tax rates. The minimum combined 2022 sales tax rate for Nassau County New York is 863.

Nassau County Residential Commercial Real Estate Data Propertyshark

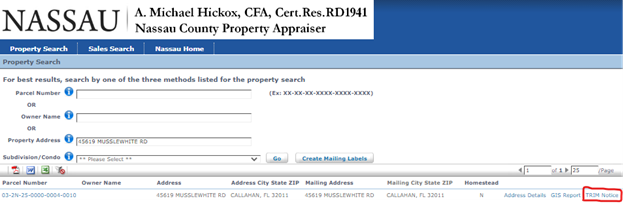

The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property.

. Remember you can only file once per year. When they moved into a new Plainview development last year residents like the Blattbergs thought property taxes on their two-bedroom apartment would be around 20000. Nonhomestead properties have an assessment cap of.

Ad Our Highly Experienced Team Can Help You Lower Your Property Taxes. This is the total of state and county sales tax rates. Cobra charges only 40 of the tax reduction secured through the assessment reduction.

Suffolk County is a fraction more expensive clocking in at an average of 23 of. Ad Our Highly Experienced Team Can Help You Lower Your Property Taxes. First-half of general taxes deadline extended in Nassau County and North Hempstead.

First-half of the 2021 general tax payments must be postmarked by the US. Prior to visiting one of our. While the 2 percent figure is well above the 156 percent increase provided for in.

We provided the 2021 estimated values to the taxing authorities on May 28th so they can begin their budget process using these preliminary figures. August 24 2021. They will use these values.

Nassau County Property Tax Rate 2021 Go To Different County Lowest Property Tax Highest Property Tax No Tax Data Nassau County New York Property Tax Go To Different County. 82321 400 pm. If you are able please utilize our online application to file for homestead exemption.

Nassau County Property Appraiser. How to Challenge Your Assessment. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

Processing applications for property tax exemption and the Basic and Enhanced STAR programs for qualifying Nassau County homeowners. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county. This is the total of state and county sales tax rates.

Theres No Charge Unless We Successfully Reduce Your Tax Assessment. Wont my property taxes go down if my. You can visit their website for more information at Nassau County Property Appraiser.

After Property Tax Assessment Some Nassau County Legislators Call For Tax Assessor To Be Elected Position April 12 2021 940 PM CBS New York MASSAPEQUA NY. Based on the CPI used for 2021 previously homesteaded properties will see their assessed value increase no more than 14 this year. Municipality and school district Class code Enhanced exemption Basic exemption Date certified.

4 discount if paid in the month of November. In Nassau County you can expect to pay an average of 224 of your homes assessed fair market value. The County Executive has proposed taking 100 million from Nassau Countys allocation of funds from the American Rescue Plan and distributing this money directly to residents.

Theres No Charge Unless We Successfully Reduce Your Tax Assessment. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. In Nassau you file with the Assessment Review.

The deadline to file is March 1 2022. City of Glen Cove. Michael Hickox made the below post on the departments FaceBook page providing valuable.

Nassau County Property Appraiser A. Assessment Challenge Forms Instructions. The New York state sales tax rate is currently 4.

Postal Service on or before. 3 discount if paid in the month of December. This tax cap applies to the Nassau County general tax levy which is a portion of all homeowners tax bills.

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Definitive Guide To Property Taxes In 2021 Suffolk Nassau Ny

What Are The Taxes On Selling A House In New York

Tax Grievance Deadline 2022 Nassau Ny Heller Consultants

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Nassau County Reassessment Prompts Barrage Of Political Mailers Newsday

Category Property Appraiser The County Insider

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Definitive Guide To Property Taxes In 2021 Suffolk Nassau Ny

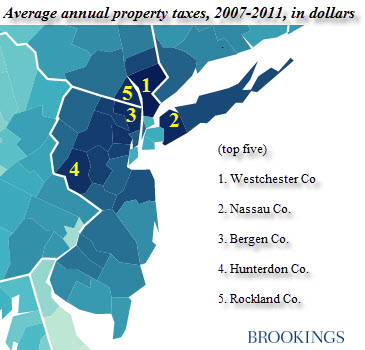

Property Taxes In Nassau County Suffolk County

Property Taxes In Nassau County Suffolk County

Florida Mortgage Calculator Smartasset

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

5 Myths Of The Nassau County Property Tax Grievance Process

Top 5 And Bottom 5 Average Property Taxes Paid By County In The U S

New York Property Tax Calculator 2020 Empire Center For Public Policy

Property Taxes In Nassau County Suffolk County

Nassau County Board Of Commission Approves Tentative Millage Rate On 4 1 Vote Fernandina Observer